Thaum "Bond King" Bill Gross zaum tsis ntev los no nrog Barry Ritholtz rau ib ntu ntawm "Cov Duab Loj" podcast, tus neeg ua lag luam billionaire thiab tus tsim PIMCO coj qhov tsis ntseeg zoo nkauj ntawm leej twg tuaj yeem tsim lub nceeg vaj tawm ntawm cov nuj nqis.

Gross hais tias "Kuv tsis xav tias leej twg tuaj yeem ua tus huab tais daim ntawv cog lus yav tom ntej vim tias cov tuam txhab nyiaj hauv nruab nrab yog cov vaj ntxwv thiab poj huab tais ntawm kev ua lag luam," Gross hais. "Lawv txiav txim - lawv txiav txim siab qhov twg cov paj laum mus," nws hais.

Tsoom Fwv Teb Chaws Reserve tam sim no xav tau cov paj laum ntau dua, muaj peev xwm sai sai li ntawd, thiab cov nyiaj txiag nruj dua li Asmeskas zoo li yuav tshwm sim los ntawm kev sib kis, tab sis nrog tus nqi siab tshaj plaws ntawm kev nyob hauv 40-xyoo. Cov nyiaj tau nce siab, tab sis cov nqi roj av, khoom noj, tsheb, vaj tse thiab ntau dua.

Cov feeb ntawm Fed lub rooj sib tham Lub Peb Hlis hnub Wednesday echoed lub central bank lub hardening stance tiv thaiv kev nce nqi, nrog rau nws cov txheej txheem ntawm kev npaj rau shrink nws ze li $ 9 trillion daim ntawv tshuav nyiaj li cas ntawm nws qhov nrawm tshaj plaws puas tau.

Nyob rau hauv ib qho surprise, cov feeb kuj tau sab laug qhib lub qhov rooj mus rau outright kev muag khoom ntawm lub central bank $ 2.7 trillion nyiaj txais-rov qab kev tuav pov hwm, txheej txheem uas muaj feem cuam tshuam xav kom lwm tus tub ua lag luam los sau qhov khoob.

Greg Handler, tus thawj coj ntawm tsev qiv nyiaj thiab cov neeg siv khoom qiv nyiaj ntawm Western Asset Management tau hais tias "Qhov tseeb, Fed tau tsom mus rau kev txo qis kev nce nqi," said Greg Handler, tus thawj coj ntawm kev qiv nyiaj qiv nyiaj thiab cov neeg siv khoom qiv nyiaj ntawm Western Asset Management, thaum sau tseg tias vaj tse tsim los ntawm. ib feem peb ntawm cov xov xwm Cov neeg siv khoom-tus nqi ntsuas, qhov ntsuas kev nce nqi tseem ceeb uas ntaus tus nqi txhua xyoo ntawm 7.9% hauv Lub Ob Hlis.

Kev nyeem ntawv tshiab yuav tsum yog hnub Tuesday, nrog Credit Suisse economists cia siab tias muaj xov xwm CPI rau lub Peb Hlis yuav nce mus txog 8.6%.

"Nws yog qee yam ntawm lawv lub hom phiaj los pov cov dej txias rau ntawm lub tsev lag luam," Handler hais hauv xov tooj. “Koj puas tuaj yeem pom qhov kho, lossis kev kho dua? Kuv xav tias muaj qee qhov kev pheej hmoo ntawm qhov ntawd. "

Dab tsi siab dhau

Fed Tus Thawj Kav Tebchaws Jerome Powell lub caij ntuj sov dhau los ua si ib qho kev sib txuas ncaj qha ntawm nws qhov kev sib kis loj loj yuav ntawm Nyiaj Txiag thiab qiv nyiaj qiv nyiaj nrog nce nqi tsev.

Tab sis Fed tau yog tus neeg yuav khoom tseem ceeb ntawm cov nuj nqis no tau ntau xyoo, thiab raws li Gross tau hais thaum lub sijhawm podcast, lub tsev txhab nyiaj hauv nruab nrab tuav cov nyiaj ntau dhau ntawm cov paj laum. Txij li thaum xyoo 2007-09 kev lag luam poob qis thiab ua rau muaj teeb meem rau kev kaw, tsoomfwv tau ua ib qho tseem ceeb hauv kev lag luam kwv yees li $ 12 trillion US vaj tse nuj nqis.

Ntau tus neeg Amelikas vam khom nyiaj txiag los yuav tsev, nrog rau lub qhov muag los tsim kom muaj nyiaj txiag ntau. Vaj tse kuj tseem yog ib feem tseem ceeb ntawm kev lag luam, uas txhais tau hais tias cov ceg txheem ntseeg siab rau yam uas yuav los tom ntej.

Mike Reynolds, tus lwm thawj coj ntawm lub tswv yim peev ntawm Glenmede tau hais tias "Peb tab tom sau tseg txog feem tseem ceeb ntawm tsev neeg cov nuj nqis tsim nyog los ntawm kev muaj vaj huam sib luag hauv tsev," said Mike Reynolds, tus lwm thawj coj ntawm cov tswv yim peev ntawm Glenmede, hais ntxiv tias tus menyuam mos boomers muaj ntau ntawm cov kwv yees li 142 lab US ib leeg-tsev neeg cov khoom lag luam.

"Nws yog ib feem ntawm kev lag luam uas muaj peev xwm ua rau tsis muaj zog ntawm lub hauv paus mus tom ntej," nws hais rau MarketWatch.

Cov paj laum qis - thiab cov khoom lag luam tsis txaus - coj cov nqi vaj tsev mus rau skyrocket rau cov ntaub ntawv tshiab thaum muaj kev sib kis, nce 19% txhua xyoo nyob rau lub Ib Hlis. Hos ib co tus nqi nce nqi zog tuaj yeem yooj yim raws li 30-xyoo ruaj tus nqi qiv nyiaj mam li nco dheev mus txog 5%, cov nqi tsev qiv nyiaj txhua hli, raws li cov nyiaj tau los, twb tau txav los ze rau qib npuas-era.

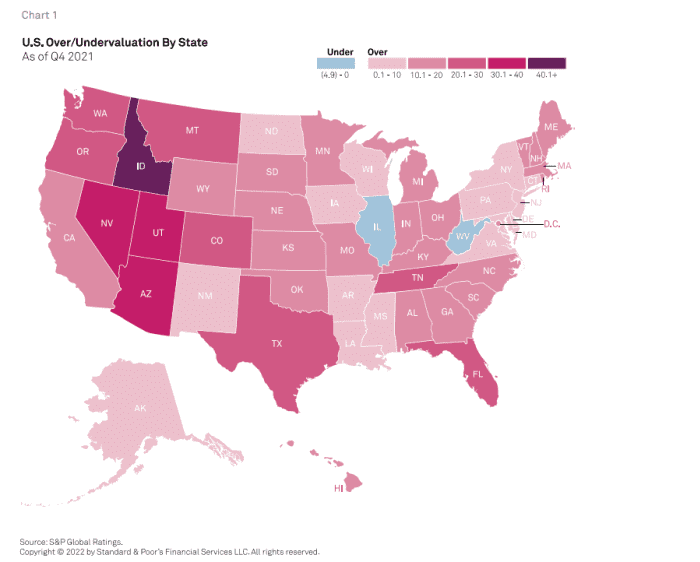

Ntawm no yog ib daim ntawv qhia qhia txog qhov cuam tshuam ntawm tus nqi nce thoob plaws hauv Teb Chaws Asmeskas los ntawm lub tuam txhab credit rating S&P Global, uas tam sim no suav txog 88% ntawm tag nrho cov cheeb tsam overvalued.

Feem ntau ntawm US vaj tse yog overvalued

S&P Global Ratings

"Puas yog qhov tseeb thiab yuav tshwm sim tuaj rau hauv kev ua lag luam?" Reynolds nug. "Nws zoo li tsis zoo li tsuas yog muab qhov kev thov thiab kev sib cuam tshuam ntawm kev muab khoom."

BofA Cov kws tshaj lij thoob ntiaj teb, nyob rau lub Plaub Hlis thaum ntxov, tau hais tias lawv cia siab tias yuav nce nqi tsev ntawm 10% xyoo no thiab 5% hauv 2023, ib qho kev hu xov tooj hauv paus hauv kev tsim vaj tsev nyob hauv lub sijhawm tom qab xyoo 2008.

Handler, tus qub tub rog qiv nyiaj, ceeb toom tias "kev kwv yees ntau yam tau dav tshaj txij li thaum muaj kev kub ntxhov xyoo 2008."

Nyob rau tib lub sijhawm, qhov chaw ntawm "lub koom haum" kev lag luam qiv nyiaj qiv nyiaj, qhov twg Fed tau yuav, twb tau rov pib dua txij li lub tuam txhab nyiaj hauv nruab nrab tau pib qhia txog qhov txo qis ntawm nws daim ntawv tshuav nyiaj li cas.

"Cov nqi qiv qis qis dua hauv 2% thiab 4% ntau yam, cov uas tau muaj kev cuam tshuam loj heev los pib lub xyoo, vim tias lub khw tau cia siab tias Fed yuav thim rov qab kev txhawb nqa rau lub caij ntuj sov, lossis ib nrab xyoo thib ob," Handler hais tias.

Ntawm qhov tod tes, nws pab neeg nyiam cov tsev nyob nrog daim coupon ntau dua, thaj chaw uas Fed tsis tau ua haujlwm, tshwj xeeb vim lawv tau txais txiaj ntsig los ntawm kev nce nqi hauv tsev sai.

"Hmoov tsis zoo rau Fed, kev lag luam vaj tsev tau kub heev," Handler hais. Tab sis hais txog qhov tsis txaus ntseeg ntawm cov khoom vaj tsev nyob, "tsis muaj ntau npaum li Fed tuaj yeem ua rau lub sijhawm no."

Dow Jones Muaj Nruab Nrab

DJIA,

eked tawm ib qho kev nce rau hnub Friday, tab sis peb lub ntsiab lus tseem ceeb

SPX,

COMP,

xaus lub lim tiam 0.2% rau 3.9% qis dua tom qab Fed feeb txhawb kev cia siab rau looming cov nyiaj txiag nruj dua. Lub 10-xyoo Treasury yield

TUBMUSD 10Y,

ntaus 2.713% Hnub Friday, nws qhov siab tshaj plaws txij li Lub Peb Hlis 5, 2019, raws li Dow Jones Market Data.

Lub lim tiam tom ntej no cov tub ua lag luam yuav hnov los ntawm ib txoj hlua ntawm Fed cov thawj coj, pib hnub Monday nrog Chicago Fed Thawj Tswj Hwm Charles Evans. Tab sis cov khoom loj nyob rau hauv Teb Chaws Asmeskas Economic calendar tuaj hnub Tuesday nrog CPI nyeem ntawv rau lub Peb Hlis, ua raws li kev thov tsis muaj haujlwm thiab cov khw muag khoom hnub Thursday thiab kev tsim khoom thiab kev lag luam tshaj tawm hnub Friday.

Tau qhov twg los: https://www.marketwatch.com/story/the-housing-market-is-running-hot-can-the-fed-cool-it-before-it-crashes-11649507620?siteid=yhoof2&yptr=yahoo