Kev ua lag luam qhov kev cia siab yog tias Tsoom Fwv Teb Chaws Reserve yuav txuas ntxiv nqa nws txoj cai paj laum kom txog thaum nws coj mus rau 5% ua ntej ncua sij hawm.

Tab sis nws muaj peev xwm hais tias Fed tuaj yeem txiav txim siab tias 5% tsis yog ze li txaus. Qhov ntawd yuav yog qhov xwm txheej yog tias Asmeskas kev lag luam tseem loj hlob ntawm cov khoom sib txuas thiab kev nce nqi tsis tau txias heev.

Cov kws tshaj lij ntawm JPMorgan coj los ntawm Nikolaos Panigirtzoglou tau txiav txim siab los tshuaj xyuas qhov xwm txheej uas Fed yuav coj nws tus lej ntsuas mus rau 6.5% thaum lub sijhawm thib ob ntawm 2023. Lawv tau sau tseg tias JPMorgan pab pawg kev lag luam tau muab 28% qhov muaj feem rau qhov xwm txheej ntawd, yog li nws nyob hauv lub cheeb tsam ntawm qhov ua tau, txawm tias cov nqi lag luam tsuas yog muab 10% qhov tshwm sim rau qhov tshwm sim ntawd.

Hauv kev sib tham nrog cov neeg siv khoom, cov kws tshaj lij tau hais tias, qhov xwm txheej tau pom dav dav raws li qhov xwm txheej Armageddon. "Tom qab tag nrho, lub sijhawm kawg ntawm Fed cov nyiaj tau los ntawm 6.5% yog nyob rau hauv 2000 thiab theem ntawm txoj cai tswjfwm tau ua raws li kev poob hnyav heev rau cov lag luam pheej hmoo thaum lub sijhawm," lawv hais.

Tab sis pab pawg JPMorgan yuav tsis cia siab tias Armageddon yuav tshwm sim hauv kev lag luam nyiaj txiag. "Nyob rau hauv peb lub tswv yim, thaum tsis muaj kev tsis ntseeg me ntsis tias [Fed tus nqi ntawm 6.5%] yuav tsis zoo rau feem ntau cov cuab yeej cuab tam xws li cov khoom vaj khoom tsev, daim ntawv cog lus thiab credit, qhov kev poob qis yuav muaj tsawg dua uas Armageddon yuav hais," lawv hais. .

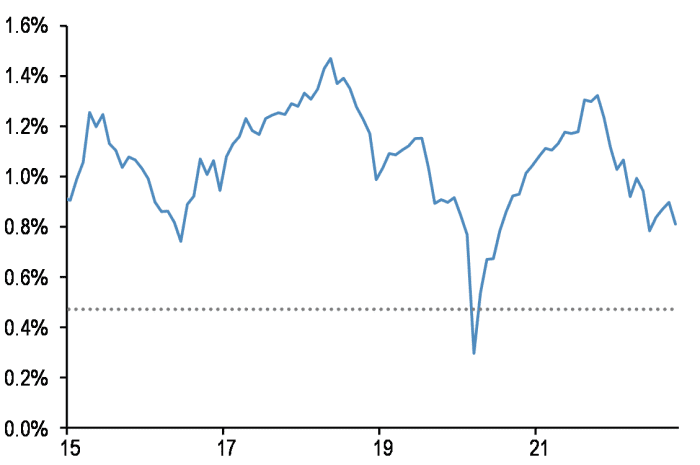

Net debit tshuav nyiaj li cas hauv NYSE margin account yog nyob rau theem qis.

Finra/NYSE/JPMorgan

Kev thov rau daim ntawv cog lus, cov kws tshaj lij tau sau tseg, twb tau poob lawm, thiab nws xav tias yuav tsis muaj zog vim tias cov tsev txhab nyiaj hauv nruab nrab koom nrog ntau qhov nruj. Lawv tau hais tias "Qhov kev thov tsis muaj zog uas tsis tau ua dhau los no tau npaj rau xyoo 2023 ua rau muaj kev cuam tshuam uas qhov kev thov yuav tshaj tawm lwm qhov tsis zoo xav tsis thoob hauv 2023 thiab ua rau muaj kev pheej hmoo siab dua," lawv hais. Ntxiv rau, kev xa khoom tau kwv yees yuav poob los ntawm $ 1.7 trillion xyoo tom ntej.

Pom zoo, Fed noj cov nqi mus rau 6.5% yuav muaj kev cuam tshuam loj ntawm qhov kawg luv

TUBMUSD 02Y,

ntawm Treasury yield nkhaus. Tab sis cov txiaj ntsig ntawm qhov kawg ntev yuav nce "los ntawm ntau tsawg," lawv hais tias, txhais tau tias muaj kev cuam tshuam ntau dua li qhov peb pom tam sim no.

Lawv tau hais cov lus zoo sib xws hauv Teb Chaws Asmeskas Tshuag lag luam, raws li Cov Khoom Muag Khoom Muag Khoom Muag Khoom Muag Khoom Muag Khoom Muag Khoom Muag ntawm cov nyiaj tau los thiab cov khoom muaj nqis saib xyuas. "Tag nrho cov kev xav tau ntawm kev ncaj ncees no sawv ntawm qhov qis qis, tsim kom muaj qhov tsis sib xws uas lwm qhov kev poob qis zoo li yuav tsawg dua rau 2023," cov kws tshuaj ntsuam tau hais.

Twb tau, lawv tau sau tseg, S&P 500

SPX,

tau pib tsis hloov pauv li ntawm xya lub hlis dhau los, txawm tias qhov siab tshaj plaws hauv Fed tus nqi tau nce mus rau 5% los ntawm ib puag ncig 3% hauv lub Tsib Hlis.

Tau qhov twg los: https://www.marketwatch.com/story/jpmorgan-looks-at-an-armageddon-scenario-of-the-fed-jacking-rates-up-to-6-5-its-conclusion-may- be-a-surprise-11670507441?siteid=yhoof2&yptr=yahoo