Cov tub ua lag luam-kev lag luam zoo li tau jittery thaum 10-xyoo Treasury yield yog trading saum 3%. Saib ntawm cov tuam txhab thiab tsoomfwv cov nuj nqis piav qhia vim li cas, raws li ib tus kws tshuaj ntsuam xyuas zoo.

"Tsis yog tsoomfwv lossis cov lag luam tsis tuaj yeem them taus +10% Cov Nyiaj Txiag Nyiaj Txiag, feem ntau nyob rau xyoo 1970s. Tias yog vim li cas 'Fed Put' yog txhua yam hais txog nyiaj txiag yields tam sim no, thiab yog vim li cas kev lag luam kev ncaj ncees tau squirrelly tshaj 3%, "hais Nicholas Colas, co-founder ntawm DataTrek Research, nyob rau hauv daim ntawv Tuesday.

Cov tub ua lag luam tau tham txog qhov piv txwv ntawm Fed txij li thaum tsawg kawg lub Kaum Hli 1987 Tshuag-kev lag luam poob ua rau Alan Greenspan-coj lub hauv paus tsev txhab nyiaj kom txo cov paj laum. Ib qho kev xaiv tiag tiag yog ib qho nyiaj txiag derivative uas muab rau tus neeg tuav txoj cai tab sis tsis yog lub luag haujlwm los muag cov cuab tam hauv qab ntawm ib theem, hu ua tus nqi tawm tsam, ua haujlwm raws li txoj cai pov hwm tawm tsam kev lag luam poob.

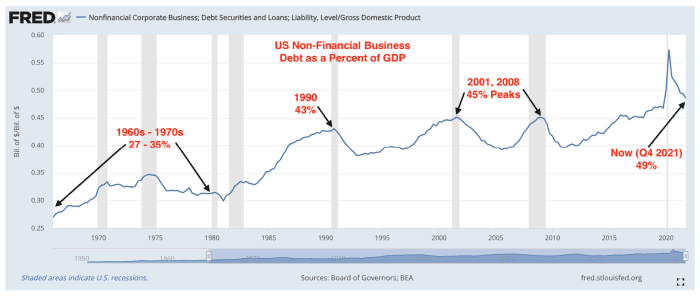

Colas tau sau tseg tias tsoomfwv Meskas cov nuj nqis rau pej xeem cov khoom lag luam yog 125% tam sim no, piv rau 31% hauv 1979. Cov nuj nqis lag luam yog sib npaug li 49% ntawm GDP piv rau 35% hauv 1979, nws hais tias (saib daim duab hauv qab).

Teb Chaws Asmeskas cov nuj nqis lag luam tsis yog nyiaj txiag (ob daim ntawv cog lus thiab qiv) raws li feem pua ntawm GDP.

Pawg Thawj Tswj Hwm, BEA, DataTrek Kev Tshawb Fawb

Cov nuj nqis lag luam-rau-GDP yog 40% siab dua nyob rau hauv kev nce nqi / nyiaj paj siab ib puag ncig ntawm xyoo 1970, Colas tau hais. Qhov ntawd yog offset los ntawm ntau qhov sib npaug sib npaug rau cov pej xeem thiab cov tuam txhab ntiag tug loj dua li xyoo 1970, nws tau sau tseg tias thaum muab cov khoom lag luam los them cov nuj nqis yuav tsis yog qhov kev xaiv nyiam rau CEOs lossis cov tswv lag luam, nws tuaj yeem ua tau yog tias tus nqi qiv nyiaj tau txais. tawm ntawm tes.

Nce cov paj laum, tau kawg, txhais tau tias cov nqi qiv nyiaj ntau dua. Thiab cov nuj nqis pej xeem thiab cov tuam txhab tam sim no yog ib feem loj ntawm Asmeskas kev lag luam ntau dua li xyoo 1970, uas yuav tsum txiav txim siab rau txhua qhov kev sib tham ntawm kev nce nqi-tawm tsam txoj cai tswj hwm nyiaj txiag, nws hais. Meanwhile, ib tug ntse muag nyob rau hauv Treasurys tau tsav cov yields, uas txav opposite rau tus nqi, nrog rau tus nqi ntawm 10-xyoo daim ntawv.

TUBMUSD 10Y,

thawb rov qab siab dua 3% rau hnub Monday thawj zaug txij thaum lub Tsib Hlis. Cov khoom lag luam tau poob rau xyoo 2022 vim tias cov txiaj ntsig tau nce siab hauv cov tshuaj tiv thaiv rau kev nce nqi kub thiab Fed cov phiaj xwm rau kev nce nqi nce ntxiv.

Lub S&P 500

SPX,

Lub hli tas los flirted nrog dais-kev lag luam thaj chaw - ib qho kev thim rov qab ntawm 20% los ntawm qhov siab tsis ntev los no - ua ntej bouncing, thaum tus nqi-rhiab heev Nasdaq Composite

COMP,

poob rau hauv kev lag luam dais ua ntej xyoo no. S&P 500 poob ntau dua 13% rau xyoo rau hnub tim, thaum Dow Jones Industrial Nruab Nrab

DJIA,

tau poob ntau dua 9% thiab Nasdaq tau poob 22.9%.

Qhov kev puas tsuaj uas tuaj yeem ua tau los ntawm 10% + Cov Nyiaj Txiag thiab cov txiaj ntsig ntawm cov tuam txhab ntawm xyoo 1970 yuav loj dua tam sim no, Colas tau hais tias, vim li cas "Fed tso" tau hloov pauv los ntawm cov khw muag khoom mus rau Lub Lag Luam Nyiaj Txiag.

Fed Chair Jerome Powell thiab nws cov phooj ywg tsim txoj cai "paub tias lawv yuav tsum khaws cov qauv kev nce nqi ntawm bay thiab Treasury yields qis. Ntau, qis dua li xyoo 1970, "nws hais.

Raws li Colas, qhov no pab piav qhia yog vim li cas Asmeskas kev lag luam kev lag luam tau poob siab thaum Cov Nyiaj Txiag Nyiaj Txiag tau nce 3%, zoo li qhov xwm txheej hauv lub quarter thib plaub ntawm 2018 thiab tam sim no.

"Nws tsis yog tias 3% tus nqi ntawm cov peev txheej tsis muaj kev pheej hmoo yog qhov tsis muaj peev xwm tswj tau, tsis yog rau tsoomfwv lossis tsoomfwv ntiag tug. Hloov chaw, nws yog txoj kev ua lag luam ntawm kev taw qhia qhov tsis txaus ntseeg yog tias tus nqi tsis nres ntawm 3%, tab sis hloov mus ntxiv, "nws hais.

Tau qhov twg los: https://www.marketwatch.com/story/why-stock-market-investors-get-squirrelly-when-bond-yields-top-3-11654607604?siteid=yhoof2&yptr=yahoo