Cov ncej no yog thawj zaug luam tawm rau TKer.co

Cov khoom lag luam tau nce qis, nrog S&P 500 poob qis 0.3% lub lim tiam dhau los. Tam sim no qhov ntsuas tau nce 6.2% xyoo rau hnub tim, nce 14% los ntawm nws lub Kaum Hlis 12 kaw qis ntawm 3,577.03, thiab nqis 15% los ntawm nws lub Ib Hlis 3, 2022 kaw siab ntawm 4,796.56.

"Lub lag luam dais dhau lawm, tab sis nws tsis yog qhov zoo tshaj plaws," Chris Harvey, tus thawj coj ntawm kev ncaj ncees ntawm Wells Fargo Securities, sau hnub Monday. "Peb tsis pom ib tug nyuj lossis ib lub khw muag khoom, tsuas yog lub khw."

Hu nws ua "'kev ua lag luam' nkaus xwb," Harvey tau hais tias nws xav tias "qee qhov muab rov qab, tab sis tsis yog qhov cuam tshuam ze rau lub sijhawm."

Tseeb, peb hnov tsawg los ntawm cov uas muaj yav dhau los kwv yees qhov muag loj nyob rau hauv Tshuag lag luam nyob rau hauv thaum ntxov ib feem ntawm lub xyoo.

Thiab thaum Harvey tus cwj pwm ntawm kev lag luam Tshuag yog me ntsis tsis meej, nws tsis yog paradoxical nyob rau hauv txoj kev muaj coob tus saib kev lag luam.

Economy zoo ces phem 🙃

Nyob rau hnub Sunday kawg TKer, Kuv tau tham txog yuav ua li cas kev coj tus cwj pwm tsis zoo rau kev lag luam tau hloov pauv bullish nyob rau hauv lub wake ntawm cov ntaub ntawv nyiaj txiag muaj zog, sau tseg tias "nws tuaj yeem siv sijhawm li ob peb lub lis piam ntxiv ntawm cov ntaub ntawv kev lag luam muaj zog ua ntej ntau tus kws tshawb fawb kev lag luam tau hloov kho lawv cov kev kwv yees mus rau qhov nce siab."

Hloov kho kom them nyiaj

Zoo, cov kev hloov kho no twb los lawm. Ua raws li hnub Wednesday cov khw muag khoom muaj zog tshaj tawm, JPMorgan, Bank of America, Thiab German Bank yog cov tuam txhab koom nrog Goldman Sachs hauv kev hloov kho lawv cov kev kwv yees nyob ze rau GDP lossis tso tawm lawv qhov kev cia siab rau kev lag luam poob qis.

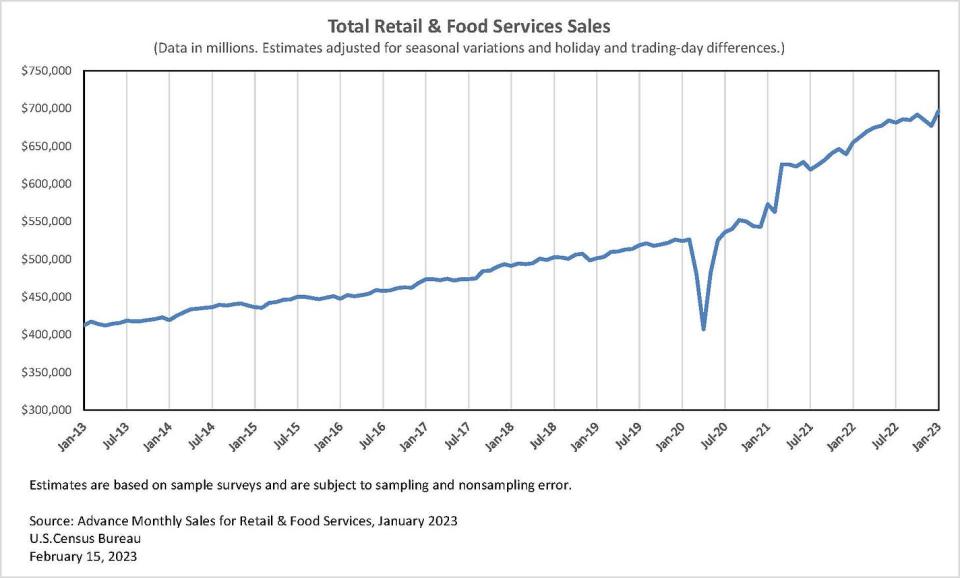

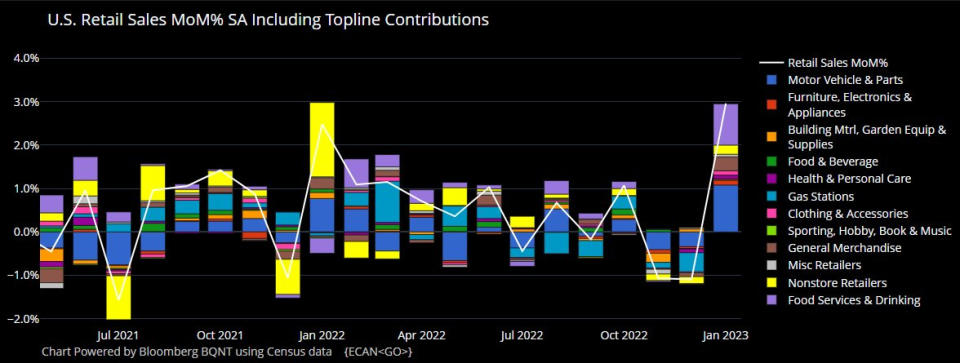

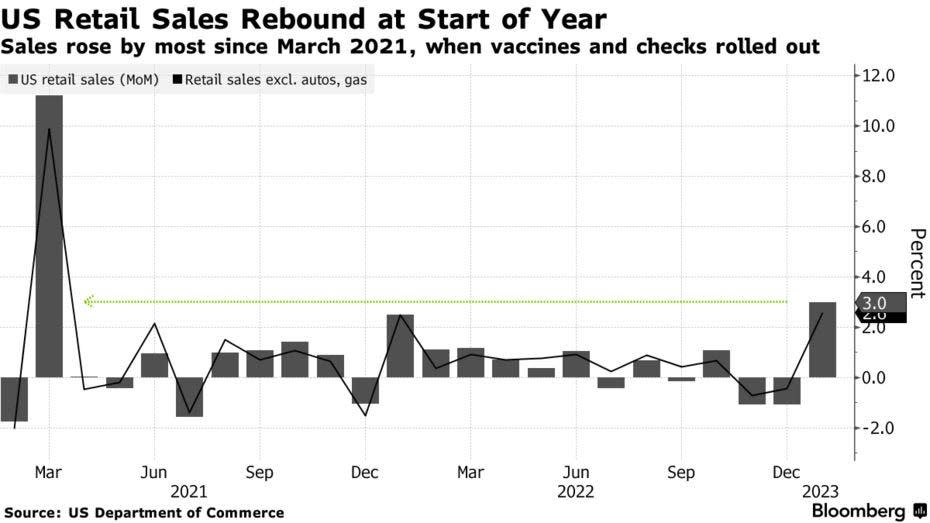

raws li Kev Suav Neeg Cov Ntaub Ntawv Kev Suav Neeg, cov khw muag khoom muag thaum Lub Ib Hlis tau dhia 3.0% rau cov ntaub ntawv $ 697 billion. Qhov no yog qhov nce loj tshaj plaws txij li lub Peb Hlis 2021, thiab nws muaj zog ntau dua li qhov 2.0% nce kev lag luam xav tau.

Tsis suav nrog tsheb thiab roj av, kev muag khoom nce siab 2.6% nrog kev nce qib hauv txhua pawg muag khoom.

Cov txiaj ntsig tau ua raws li Bank of America cov ntaub ntawv credit thiab daim debit card tso tawm ua ntej lub hli no qhia ib qho acceleration hauv kev siv nyiaj.

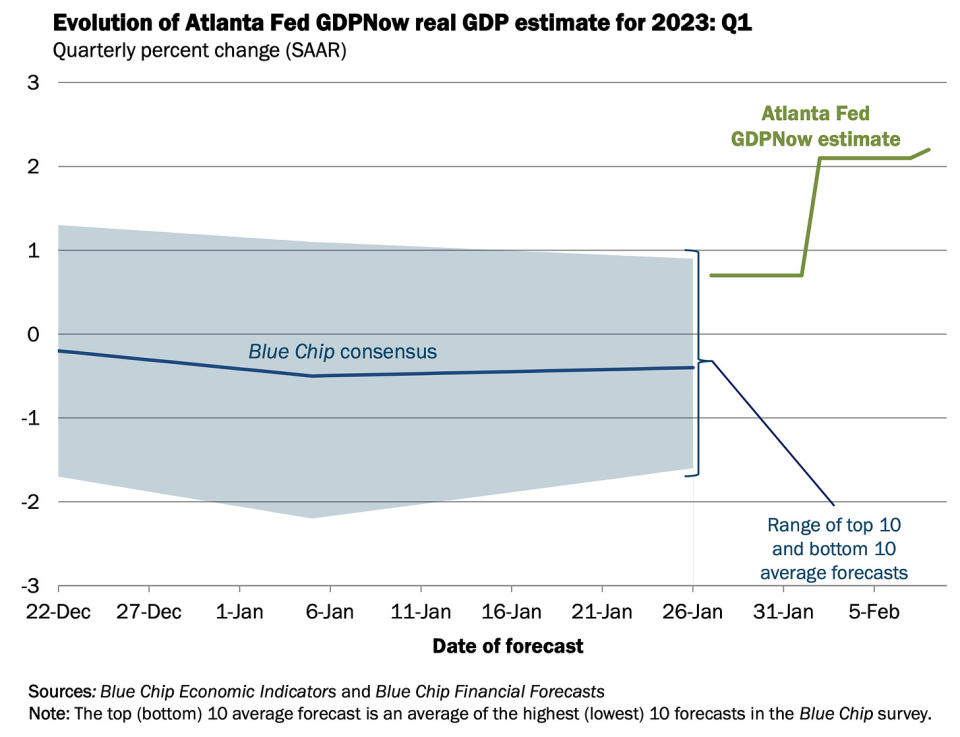

Tom qab daim ntawv tshaj tawm kev muag khoom muag tawm, lub Atlanta Fed's GDPNow qauv pom tseeb GDP kev loj hlob nce ntawm 2.4% tus nqi hauv Q1. Qhov no yog nce los ntawm 2.2% lub lim tiam dhau los, thiab nce ntau ntxiv los ntawm nws qhov kev kwv yees thawj zaug ntawm 0.7% kev loj hlob raws li lub Ib Hlis 27.

Thiab nws tsis yog tus xwb cov ntaub ntawv nyuaj uas saib rosier. Cov cov ntaub ntawv mos zoo li yuav xav txog lub suab pessimistic tsawg thiab.

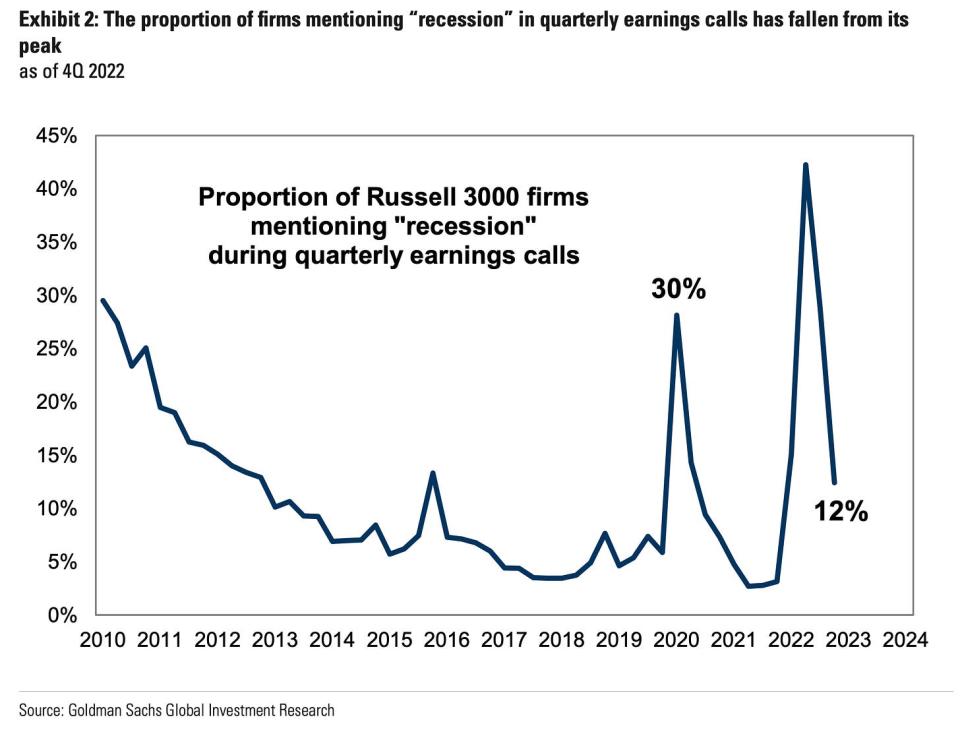

raws li Goldman Sachs kev tshawb fawb luam tawm hnub Tuesday, hais txog "kev poob qis" ntawm cov nyiaj tau los hauv peb lub hlis twg hu tau poob qis.

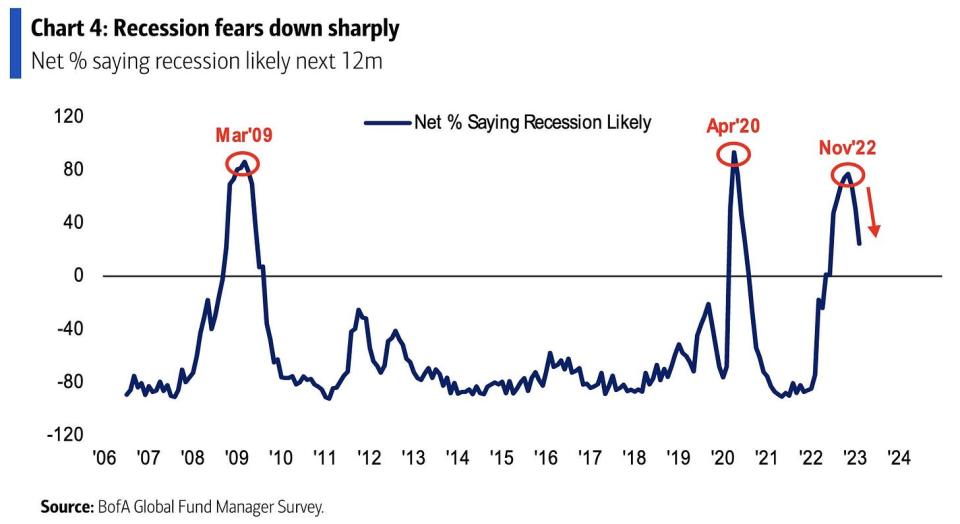

Raws li Bank of America's Ntiaj teb no Fund Manager Survey luam tawm hnub Wednesday, "Kev poob nyiaj poob qis tau nce siab thaum Lub Kaum Ib Hlis 22 ntawm 77% thiab txij li tau poob mus rau 24% lub hlis no (qis 27ppt MoM), qis tshaj txij li Lub Rau Hli 22."

Tseeb, kev xav txog kev loj hlob ntawm kev lag luam tau hloov pauv mus rau sab xis.

Yuav kom ncaj ncees, nws yog qhov nyuaj rau kev txheeb xyuas qhov tseeb tias kev lag luam yuav ua li cas rau yav tom ntej. Tab sis lub confluence ntawm cov ntaub ntawv - suav nrog muaj zog siv nyiaj txiag thiab muaj zog thov rau cov neeg ua haujlwm - tau hais tias muaj kev tsis ncaj ncees rau qhov upside. Yog xav paub ntxiv, nyeem: 9 yog vim li cas thiaj li muaj kev cia siab rau kev lag luam thiab kev lag luam 💪

Hmoov tsis zoo, ntau tus kws tshawb fawb nyiaj txiag tsis zoo siab vim nws ua rau muaj kev pheej hmoo kev siv zog tsis tu ncua los coj kev nce nyiaj txiag.

Nov yog qhov teeb meem nrog txhua qhov no 🤦🏻♂️

Cov kev xav uas xov xwm zoo txog kev lag luam yog xov xwm phem rau kev nce nqi tau rov ua dua tshiab tom qab muaj cov ntaub ntawv muaj zog heev ntawm kev ua lag luam thiab cov neeg siv khoom siv.

Conor Sen, tus kws sau xov xwm rau Bloomberg Tswvyim, "Kuv qhov kev coj tshiab yog xov xwm zoo yog xov xwm zoo, xov xwm zoo yog xov xwm tsis zoo," tweeted lub lim tiam dhau los.

Nrog rau ntau tus kws tshawb fawb kev lag luam nce siab rau lawv cov kev kwv yees kev loj hlob ntawm kev lag luam yog hawkish hloov kho rau lawv cov kev cia siab rau txoj hauv kev ntawm txoj cai nyiaj txiag: German Bank, UBS, Bank of America, Thiab Goldman Sachs yog ntawm cov tuam txhab ceeb toom tias Fed yuav nce cov paj laum ntau dua li qhov kev cia siab yav dhau los thaum nws txuas ntxiv nws txoj kev sib ntaus kom txo qis nyiaj txiag.

Thiab hawkish txoj cai nyiaj txiag sawv cev rau lub taub hau rau kev lag luam thiab kev lag luam nyiaj txiag.

Hloov kho kom them nyiaj

Saib dab tsi 👀

Cov lus nug loj yog rau qib twg lub zog hauv kev lag luam cuam tshuam qhov kev poob qis tam sim no hauv kev nce nqi. Hauv lwm lo lus, peb puas yuav kawm tias qhov Fed qhov kev thov tias cov txheej txheem disinflationary pib yog ntxov ntxov?

Nws tsis pab lub lim tiam dhau los tus nqi siv thiab tus nqi tsim khoom cov ntawv ceeb toom tau kub dua li qee qhov xav tau.

Tab sis ib lub hlis cov ntaub ntawv yeej tsis lees paub lossis tsis lees paub qhov sib txawv. Tej zaum peb tseem nyob ntawm txoj kev mus ua tiav goldilocks scenario qhov twg kev nce nqi nqis los yam tsis muaj kev lag luam yuav tsum mus rau hauv kev lag luam nyiaj txiag.

Peb yuav tau tos thiab saib.

Qhov ntawd yog qhov nthuav! 💡

Los ntawm NBER daim ntawv tshiab hu ua "Algorithmic Sau Kev Pabcuam ntawm Cov Neeg Nrhiav Haujlwm 'Resumes nce ntiav neeg ua haujlwm":

Muaj kev sib raug zoo ntawm qhov zoo ntawm kev sau ntawv hauv daim ntawv qhia txog kev ua lag luam tshiab rau cov neeg ua haujlwm tshiab thiab seb cov neeg nkag mus rau qhov kawg tau ntiav. Peb pom tias qhov kev sib raug zoo no yog, tsawg kawg yog ib feem, ua rau: kev sim ua haujlwm hauv kev ua lag luam online tau ua nrog ze li ib nrab lab tus neeg nrhiav haujlwm nyob rau hauv uas pab pawg kho mob tau txais kev pab sau ntawv algorithmic. Cov neeg nrhiav haujlwm kho mob tau ntsib 8% nce hauv qhov tshwm sim ntawm kev ntiav. Raws li kev txhawj xeeb tias qhov kev pab cuam tshem tawm qhov teeb meem tseem ceeb, peb pom tsis muaj pov thawj tias cov tswv ntiav tsis txaus siab ...

Tshawb xyuas cov macro crosscurrents 🔀

Muaj ob peb lub ntsiab lus tseem ceeb ntawm lub lim tiam dhau los los xav txog:

🛍️ ib Cov neeg siv khoom siv nyiaj. raws li Kev Suav Neeg Cov Ntaub Ntawv Kev Suav Neeg Hnub Wednesday, kev muag khoom muag hauv Lub Ib Hlis tau dhia 3.0% rau cov ntaub ntawv $ 697 billion. Yog xav paub ntxiv txog kev muag khoom muag, saib saum toj no.

🏭 Kev ua lag luam ua kom txias rau qhov tsis yog-qhov txaus ntshai. Muaj kev ua haujlwm ntau lawm kev loj hlob tau tiaj tus nyob rau lub Kaum Ob Hlis. Cov khoom tsim tawm tau nce 1.0%. Lub hauv paus tseem ceeb ntawm kev qaug zog yog los ntawm ib yam dab tsi tsis yog txhua tus yuav yws txog. Los ntawm Federal Reserve: "Cov khoom siv hluav taws xob poob qis 9.9% thaum Lub Ib Hlis, raws li lub viav vias los ntawm huab cua txias tsis zoo nyob rau lub Kaum Ob Hlis mus rau huab cua sov tsis zoo nyob rau lub Ib Hlis ua rau muaj kev ntxhov siab rau qhov kev thov cua sov."

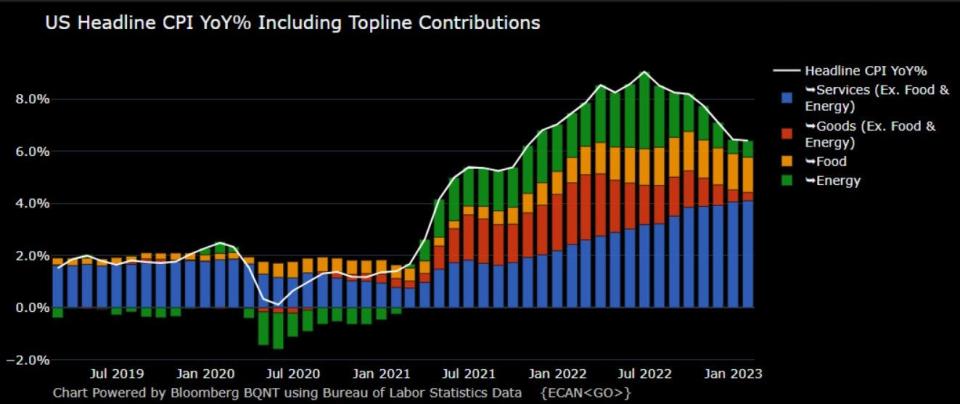

🎈 Inflation tseem txias. cov tus neeg siv khoom tus lej ntsuas (CPI) thaum Lub Ib Hlis tau nce 6.4% los ntawm ib xyoo dhau los, nqis los ntawm 6.5% thaum Lub Kaum Ob Hlis.

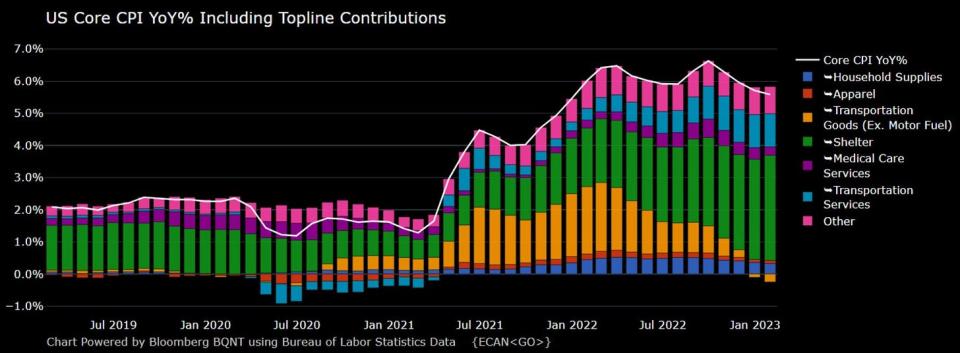

Kho cov nqi khoom noj thiab lub zog, CPI tseem ceeb tau nce 5.6% (qis los ntawm 5.7%).

Nyob rau lub hli dhau ib hlis, CPI tau nce 0.5% thiab cov tub ntxhais CPI tau nce 0.4%.

Yog hais tias koj ib xyoos ib zaug ntawm peb lub hlis sib txawv nyob rau hauv cov nuj nqis txhua hli, CPI yog nce ntawm 3.5% tus nqi thiab cov tub ntxhais CPI nce ntawm 4.6% tus nqi.

Cov kab hauv qab yog tias thaum tus nqi nce nqi tau trending qis, lawv tseem nyob saum Tsoom Fwv Teb Chaws Reserve lub hom phiaj ntawm 2%. Yog xav paub ntxiv txog qhov cuam tshuam ntawm kev txo qis qis, nyeem: Lub bullish 'goldilocks' mos tsaws scenario uas txhua tus xav tau 😀.

👍 Kev cia siab rau kev nce nqi yooj yim. Los ntawm New York Fed Lub Ib Hlis Kev soj ntsuam ntawm cov neeg siv khoom cia siab: "Qhov kev cia siab nruab nrab ntawm kev nce nqi tseem tsis tau hloov pauv ntawm lub xyoo tom ntej qab ntug, txo qis los ntawm 0.3 feem pua ntawm lub qab ntug peb lub xyoos, thiab nce 0.1 feem pua ntawm tsib xyoos tom ntej qab ntug, mus rau 5.0%, 2.7% thiab 2.5%, feem.

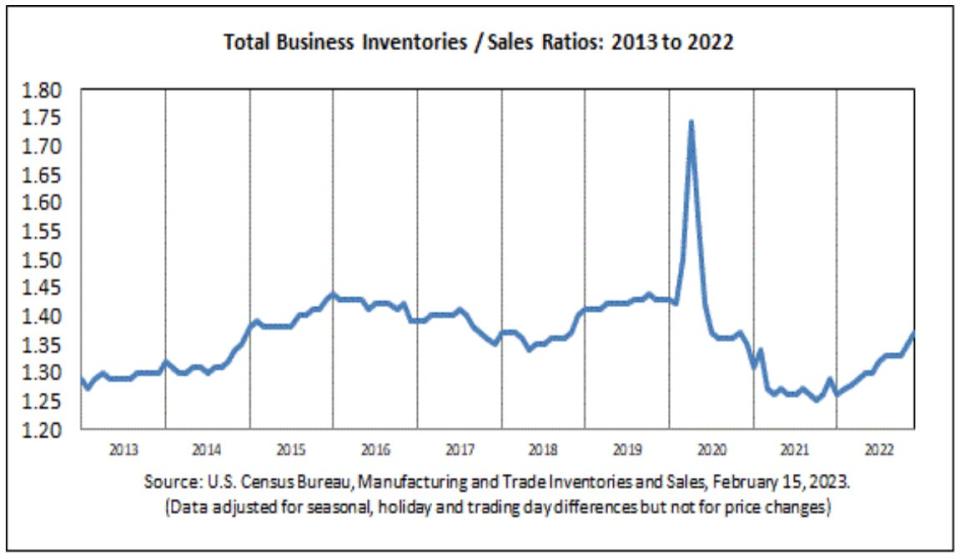

📈 Cov khoom lag luam qib nce. raws li Kev Suav Neeg Cov Ntaub Ntawv Kev Suav Neeg tso tawm hnub Wednesday, kev lag luam cov khoom lag luam nce 0.3% rau $ 2.45 trillion nyob rau lub Kaum Ob Hlis. Cov khoom muag / muag piv yog 1.37, nce ntau ntawm 1.29 xyoo dhau los.

Yog xav paub ntxiv txog cov saw hlau thiab qib khoom muag, nyeem: Peb tuaj yeem txwv tsis pub hu nws yog qhov teeb meem ntawm cov khoom lag luam ⛓, 9 yog vim li cas thiaj li muaj kev cia siab rau kev lag luam thiab kev lag luam 💪, Thiab Lub bullish 'goldilocks' mos tsaws scenario uas txhua tus xav tau 😀.

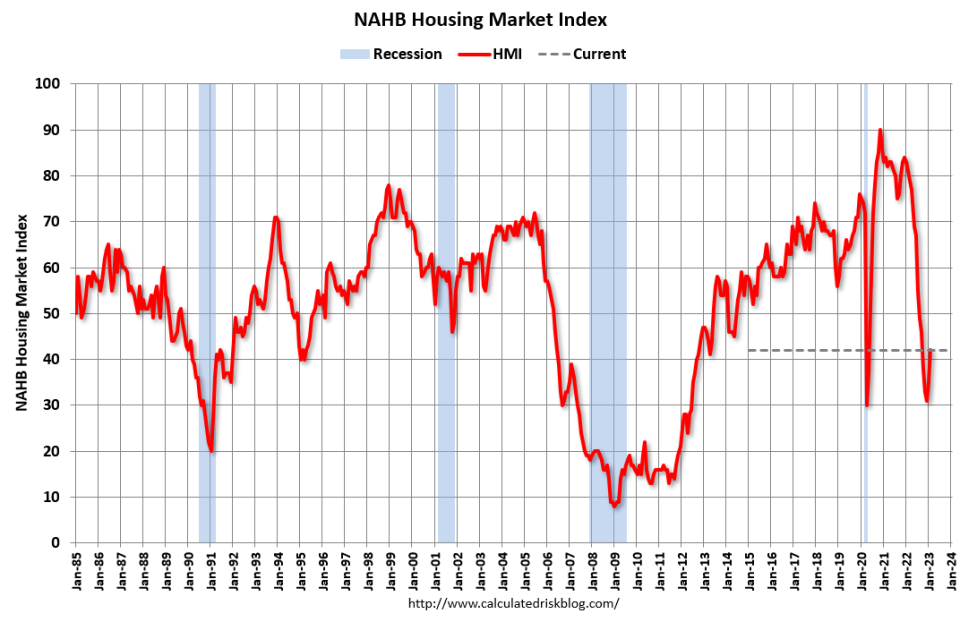

🏠 Kev tsim vaj tsev kev xav tau txhim kho. raws li HLB data tso tawm hnub Wednesday, lub tsev tsim kev xav tau txhim kho nyob rau lub Ob Hlis. Los ntawm NAHB tus kws tshaj lij nyiaj txiag Robert Dietz: "Txawm hais tias HMI tseem qis dua qhov sib tw ntawm 50, qhov nce ntawm 31 txog 42 txij lub Kaum Ob Hlis mus txog Lub Ob Hlis yog qhov cim zoo rau kev ua lag luam. Txawm hais tias Tsoom Fwv Teb Chaws Reserve tseem txuas ntxiv nruj cov cai tswj hwm nyiaj txiag, kev kwv yees qhia tau hais tias kev lag luam vaj tsev tau dhau cov nqi qiv nyiaj siab tshaj rau lub voj voog no. Thiab thaum peb cia siab tias tsis tu ncua rau cov nqi tsev qiv nyiaj thiab cov nqi tsev, lub tsev lag luam yuav tsum muaj peev xwm ua kom muaj kev ruaj ntseg nyob rau lub hlis tom ntej, tom qab ntawd rov qab mus rau theem kev tsim tsev tom qab xyoo 2023 thiab pib xyoo 2024. "

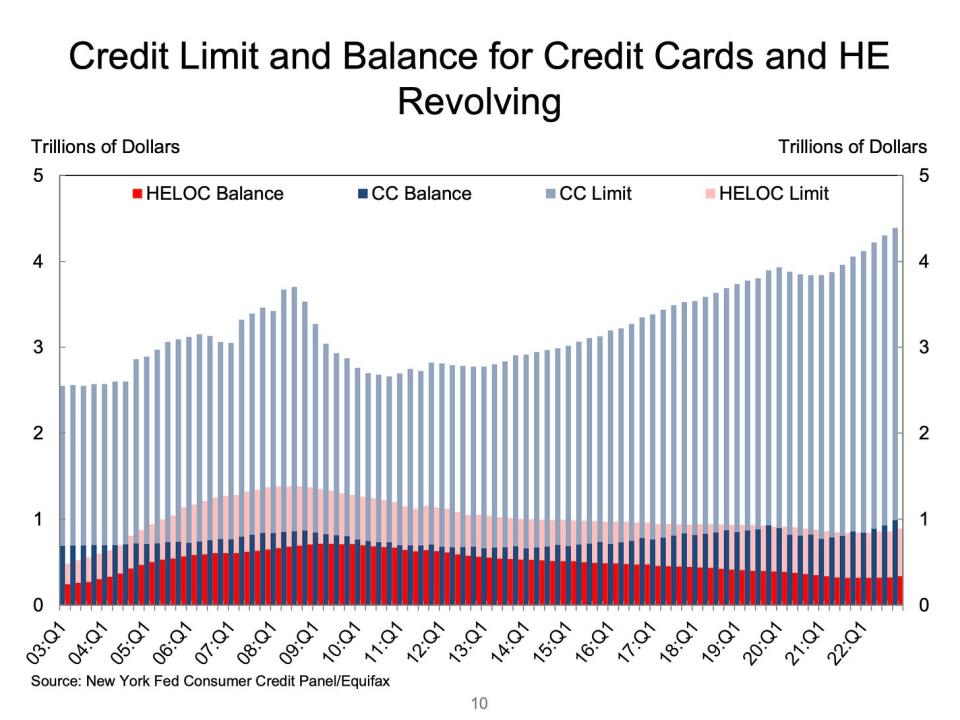

💳 Cov credit card tshuav nyiaj li cas. Raws li NY Fed cov ntaub ntawv, cov credit card tshuav nyiaj tau nce los ntawm $ 61 nphom kom ncav cuag $ 986 nphom thaum Q4, uas yog siab dua qhov kev sib kis loj tshaj plaws ntawm $ 927 billion. Nrog rau tag nrho cov credit txwv ntawm $ 4.4 trillion, txawm li cas los xij, cov neeg siv khoom yog deb ntawm maxing tawm lawv daim npav.

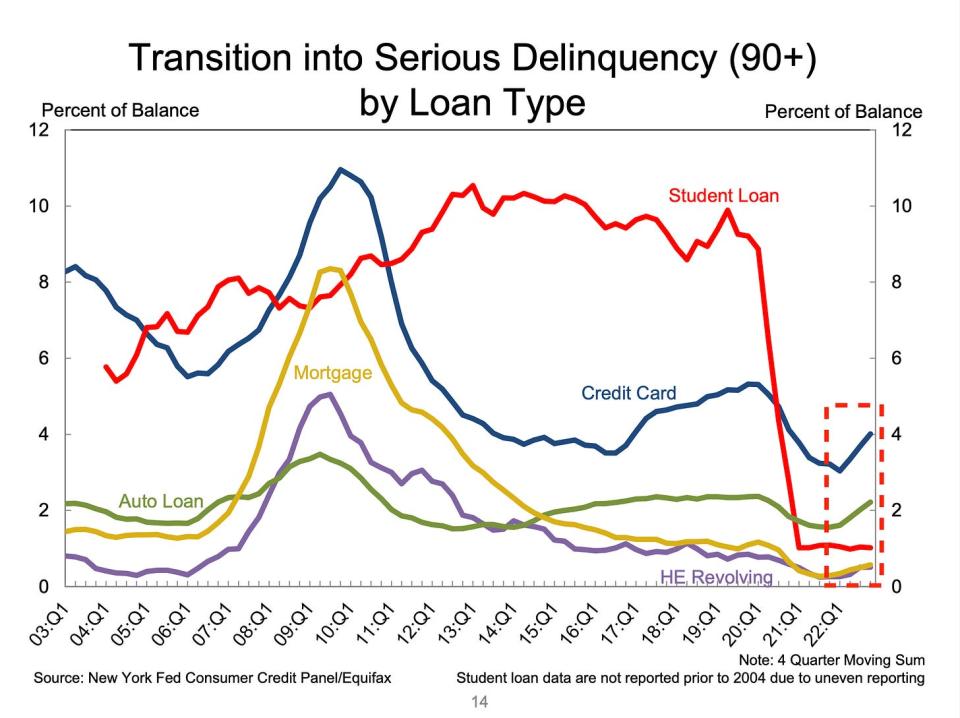

👎 Cov nuj nqis delinquencies tseem mus normalize. Los ntawm New York Fed: "Qhov feem ntawm cov nuj nqis tshiab hloov pauv mus rau qhov tsis txaus ntseeg tau nce rau yuav luag txhua hom nuj nqis, tom qab ob xyoos ntawm kev hloov pauv keeb kwm qis qis. Cov kev hloov pauv mus rau qhov tsis txaus ntseeg thaum ntxov rau cov npav rho nyiaj thiab qiv nyiaj pib tau nce los ntawm 0.6 thiab 0.4 feem pua cov ntsiab lus, tom qab qhov loj sib xws hauv peb lub hlis thib ob thiab thib peb. Kev hloov pauv tsis zoo rau cov nyiaj qiv nyiaj upticed los ntawm 0.15 feem pua cov ntsiab lus. Cov nyiaj qiv rau cov tub ntxhais kawm tau nyob twj ywm, vim tias tsoomfwv cov nyiaj them rov qab tseem nyob hauv qhov chaw. " Yog xav paub ntxiv txog qhov no, nyeem: Cov nuj nqis delinquency yog normalizing 💳.

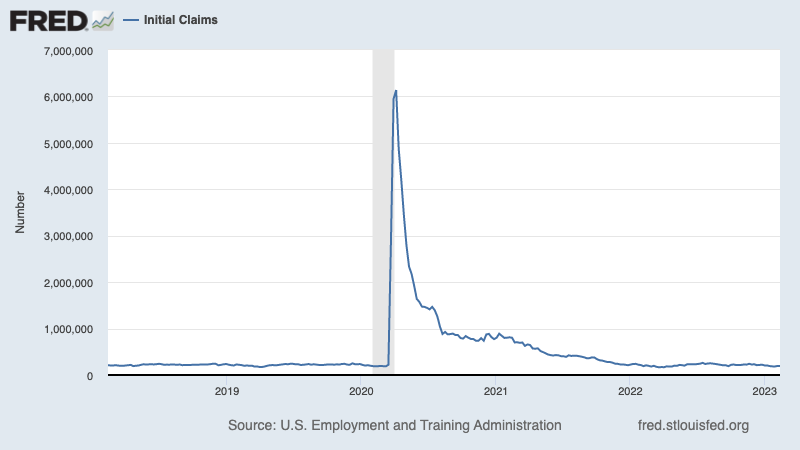

💼 Kev thov nyiaj poob haujlwm tseem tsawg. Thawj daim ntawv thov nyiaj poob haujlwm poob rau 194,000 thaum lub lim tiam xaus Lub Ob Hlis 11, nqis los ntawm 195,000 lub lim tiam ua ntej. Thaum tus lej nce los ntawm nws rau xyoo kaum qis ntawm 166,000 thaum Lub Peb Hlis 2022, nws tseem nyob ze rau theem pom thaum lub sijhawm nthuav dav kev lag luam.

Yog xav paub ntxiv txog kev poob haujlwm tsawg, nyeem: Qhov ntawd yog ntiav ntau heev 🍾, Koj yuav tsum tsis txhob xav tsis thoob los ntawm lub zog ntawm kev ua lag luam 💪, ib 9 yog vim li cas thiaj li muaj kev cia siab rau kev lag luam thiab kev lag luam 💪.

Muab tag nrho ua ke 🤔

Peb tau txais ntau yam pov thawj uas peb tuaj yeem tau txais bullish "Goldilocks" soft landing scenario qhov twg kev nce nyiaj nce mus rau qib tswj tau yam tsis muaj kev lag luam yuav tsum poob rau hauv kev lag luam.

Thiab Tsoom Fwv Teb Chaws Reserve tsis ntev los no tau txais ib lub suab nrov tsawg, lees paub rau lub Ob Hlis 1 tias "rau thawj zaug uas cov txheej txheem disinflationary tau pib."

Txawm li cas los xij, kev nce nqi tseem yuav tsum tau nqis los ntau dua ua ntej Fed nyiam nrog cov nqi qib. Yog li peb yuav tsum cia siab rau Central bank mus txuas ntxiv nruj txoj cai nyiaj txiag, uas txhais tau hais tias peb yuav tsum tau npaj rau cov nyiaj txiag nruj dua (xws li cov paj laum siab dua, cov qauv qiv nyiaj nruj dua, thiab cov nqi qis dua). Tag nrho cov no txhais tau tias kev ua lag luam beatings yuav txuas ntxiv mus thiab kev pheej hmoo ntawm kev lag luam poob nyob rau hauv ib tug recession yuav kuj yuav elevated.

Nws yog ib qho tseem ceeb uas yuav tsum nco ntsoov tias thaum muaj kev pheej hmoo nyiaj txiag tau nce siab, cov neeg siv khoom tau los ntawm txoj haujlwm nyiaj txiag muaj zog heev. Cov neeg poob haujlwm yog tau hauj lwm. Cov uas muaj hauj lwm tau nce. Thiab ntau tseem muaj kev txuag nyiaj ntau dhau coj mus rhaub rau hauv. Qhov tseeb, cov ntaub ntawv siv nyiaj muaj zog tau lees paub qhov kev tiv thaiv nyiaj txiag no. Yog li nws yog ntxov dhau mus rau suab tswb los ntawm kev pom kev noj.

Hauv qhov no, txhua yam downturn tsis zoo li yuav tig mus rau hauv kev puas tsuaj nyiaj txiag muab tias lub nyiaj txiag kev noj qab haus huv ntawm cov neeg siv khoom thiab kev lag luam tseem muaj zog heev.

Raws li ib txwm muaj, cov tub ua lag luam mus sij hawm ntev yuav tsum nco ntsoov qhov ntawd kev poob qis thiab dais lag luam yog xwb ib feem ntawm qhov deal thaum koj nkag mus rau hauv Tshuag lag luam nrog lub hom phiaj ntawm kev tsim cov nyiaj rov qab mus sij hawm ntev. Thaum kev lag luam tau muaj lub xyoo txaus ntshai, qhov kev cia siab ntev ntev rau cov khoom lag luam tseem zoo.

Yog xav paub ntxiv txog vim li cas qhov no yog ib qho chaw tsis zoo rau kev ua lag luam, nyeem: Kev lag luam beatings yuav txuas ntxiv mus txog thaum kev nce nyiaj nce ntxiv 🥊 »

Yog xav paub ntxiv txog qhov peb nyob qhov twg thiab peb tuaj ntawm no li cas, nyeem: Qhov nyuaj ntawm kev lag luam thiab kev lag luam, piav qhia 🧩 »

Cov ncej no yog thawj zaug luam tawm rau TKer.co

Sam Ro yog tus tsim ntawm Tker.co. Koj tuaj yeem ua raws nws ntawm Twitter ntawm @SamRo

Nyeem cov xov xwm tshiab nyiaj txiag thiab lag luam los ntawm Yahoo Finance

Rub tawm Yahoo Nyiaj Txiag app rau Kua or Android

Ua raws li Yahoo Finance Twitter, Facebook, Instagram, Flipboard, LinkedIn, Thiab YouTube

Tau qhov twg los: https://finance.yahoo.com/news/economic-forecasts-are-getting-revised-up-and-people-arent-thrilled-about-it-135118589.html